by T. Christian Rollins, MBA, CFRE

Samaritan’s Chief Development Officer

Whether with a local community foundation, or through a large investment firm, Donor Advised Funds (DAF) have increased in popularity over the past few years.

While a majority of households are no longer able to itemize their charitable contributions and resulting deductions, many savvy donors find it appealing and advantageous to “time” or “bundle” contributions to their DAF.

For example: Donors may elect to make a single contribution – directly to Samaritan or to your DAF – every other or every few years, which exceeds the standard deduction, and recoups their charitable income-tax deduction. DAF-holders can then make an annual gift or distribution from their fund, allowing them to sustain their vital and appreciated annual support. Using a DAF to “front-load” charitable contributions can earn back the charitable income-tax deduction, producing current tax savings. In the years that they do occur, these “intermittent” itemized deductions will make every other potential itemized deduction even more valuable, since 100% of those additional deductions will exceed the standard deduction, and earn additional tax relief.

If you are among the many who have created a Donor Advised Fund, now is the time to put your DAF to work, right here, in your community, providing essential annual support to your favorite charities.

To learn more about giving through your Donor Advised Fund, and the many other potential tax advantages of charitable estate planning, please contact Chris Rollins, CFRE at (856) 522-3287 or [email protected]. Samaritan Healthcare & Hospice, Inc. is a 501(c)(3), not-for-profit organization (EIN: 22-2344036); headquartered at 3906 Church Road, Mount Laurel, NJ 08054.

by Sean Barker, Vice President at Bernstein Private Wealth Management, and a member of Samaritan’s Planned Giving Committee, a group of the region’s leading financial advisors, volunteering their time and expertise to advance charitable estate planning.

by Sean Barker, Vice President at Bernstein Private Wealth Management, and a member of Samaritan’s Planned Giving Committee, a group of the region’s leading financial advisors, volunteering their time and expertise to advance charitable estate planning.

Individuals often struggle with the best way to structure their charitable gifts. Increasingly, they’re turning to donor-advised funds (DAF). To learn about what a DAF is and how it works, I’m pleased to share a blog written by two of my colleagues, Anne Bucciarelli and Jennifer Ostberg from Bernstein’s Wealth Strategies team, with the generous supporters of Samaritan Healthcare and Hospice. Individuals often struggle with the best way to structure their charitable gifts. Increasingly, they’re turning to donor-advised funds (DAF). To learn about what a DAF is and how it works, I’m pleased to share a blog written by two of my colleagues, Anne Bucciarelli and Jennifer Ostberg from Bernstein’s Wealth Strategies team, with the generous supporters of Samaritan Healthcare and Hospice.

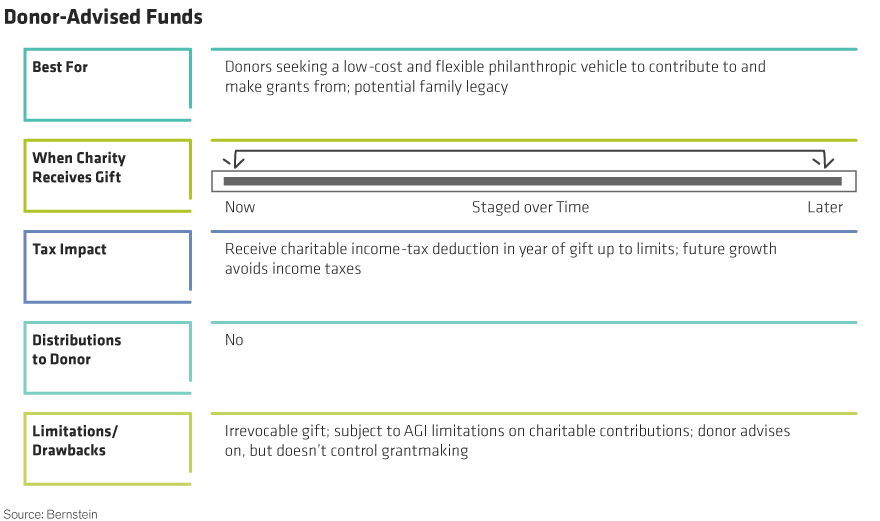

With so many vehicles for charitable giving, sometimes donors find it hard to choose. Here’s a versatile strategy that can play many roles.Donor-advised funds (DAFs) have been the fastest-growing vehicles for charitable giving in recent years because they offer a flexible and relatively low-cost way to give over many years—and a large, upfront tax deduction.As a donor, you will be eligible for an immediate charitable income-tax deduction* for the full amount of the gift to a DAF, although the grants may be distributed over many years. Funding a DAF is especially attractive in years when your income is unusually high, perhaps because you sold a business, received an outsized bonus, or saw restricted stock vest. But that’s not the only catalyst. Donors turn to DAFs for a host of other reasons, including:

A DAF is an account or fund that you create at a sponsoring organization that is itself a qualified public charity—perhaps a community foundation, faith-based organization, or specialized provider. As the donor, you make an irrevocable contribution of cash or securities (including highly appreciated stock), which the DAF administrator can sell without triggering capital gains tax. Typically, the DAF administrator reinvests the cash proceeds in a diversified portfolio that will fund grants to not-for-profit programs.The sponsoring organization sets up and administers the accounts, performs due diligence, and makes grants. As a result, the legal and accounting fees that the donor pays and the demands on the donor’s time are relatively low.

Most DAFs have fairly longtime horizons, often a decade or two. Unlike private, nonoperating foundations, DAFs are not subject to annual giving requirements: They can give as little as 0% or as much as 100% of their assets in any year.Most DAF programs will make grants in a way that does not disclose your identity, if you prefer anonymity. But DAFs can also make a gift public, if the donor wants to attract attention to a cause or be associated with the gift.The chief drawback is that when you donate assets to a DAF, you relinquish legal control. You submit recommendations for grants to the DAF administrator. Most of the time, the administrator will follow your recommendations, but there’s no guarantee. DAF sponsors and administrators also have the right to introduce restrictions on investments or grantees at any time and can refuse a particular grant request, perhaps because the philanthropic cause, the geographic region, or the grantee lies outside the administrator’s area of interest.Determining an appropriate asset allocation and spending policy to recommend requires careful consideration of your charitable goals and the needs of the causes or organizations the DAF supports. But it’s time well spent—this is one utility player you’ll be glad to have on your team.

*Under the Tax Cuts and Jobs Act, itemized deductions are mostly limited to mortgage interest, state and local taxes (capped at $10,000), and charitable gifts. At the same time, the standard deduction was increased to $12,000 for individuals and $24,000 for married couples filing jointly. For those who have itemized deductions that exceed the standard deduction, under the Internal Revenue Code as it now stands, the maximum deduction you can use in any year is equal to 60% of your adjusted gross income (AGI), if you donate cash. If you donate appreciated assets, the maximum deduction you can use in any year is equal to 30% of your AGI. Deductions not used can be carried forward for five years.

The views expressed herein do not constitute, and should not be considered to be, legal or tax advice. The tax rules are complicated, and their impact on a particular individual may differ depending on the individual’s specific circumstances. Please consult with your legal or tax advisor regarding your specific situation.

As always, we recommend contacting your trusted financial advisor. To learn more about supporting Samaritan through your will or estate plan, special donor recognition accorded through membership in The Legacy Society, and the potential advantages of charitable estate planning, please contact Chris Rollins, CFRE at (856) 552-3287 or [email protected]. Samaritan Healthcare & Hospice, Inc. is a 501(c)(3), not-for-profit organization (EIN: 22-2344036); headquartered at 3906 Church Road, Mount Laurel, NJ 08054.